|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Discovering the Best Home Refinance Deals for Your NeedsUnderstanding Home RefinancingHome refinancing is the process of replacing your current mortgage with a new one, often with better terms. This can help reduce monthly payments, shorten the loan term, or access home equity. Why Refinance?People refinance their homes for several reasons:

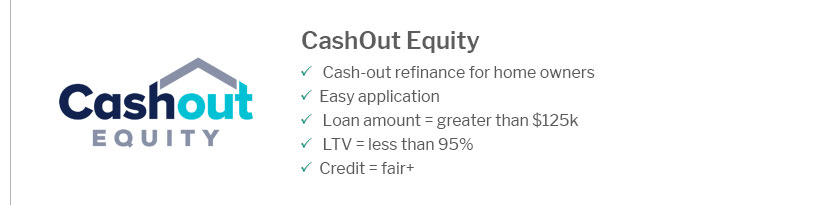

How to Find the Best Refinance DealsCompare RatesStart by comparing rates from various lenders. This will give you a clear picture of the market and help you identify the most competitive offers. Consider the CostsRefinancing comes with fees. Ensure you understand these costs, including application, appraisal, and closing fees. Top LendersChoosing the right lender is crucial. Some of the top refinance banks offer great rates and customer service. Common Mistakes to Avoid

FAQWhat is the ideal time to refinance?The ideal time is when interest rates are lower than your current rate, and you plan to stay in your home long enough to recoup refinancing costs. Can I refinance with bad credit?Yes, but it may be challenging. Lenders typically offer higher rates for lower credit scores, so improving your credit before refinancing is advisable. How does refinancing affect my credit score?Refinancing can initially lower your credit score due to hard inquiries but may improve over time with consistent payments on a new loan. https://www.bankofamerica.com/mortgage/refinance/

Today's competitive refinance rates ; 30-year fixed - 7.125% - 7.311% - 0.710 ; 15-year fixed - 6.125% - 6.453% - 0.942 ; 5y/6m ARM - 7.250% - 7.382% - 0.887. https://www.canstar.com.au/home-loans/home-loan-offers/

Best home loan cashback offers and deals - ANZ $2000 refinance cashback - BankVic Up to $3,000 cashback for healthcare, police and emergency ... https://www.bankrate.com/mortgages/refinance-rates/

Weekly national mortgage interest rate trends ; 30 year fixed refinance, 7.13% ; 15 year fixed refinance, 6.42% ; 10 year fixed refinance, 6.34% ; 5/1 ARM refinance ...

|

|---|